January 23, 2019 - GALLUP

by Dan Witters

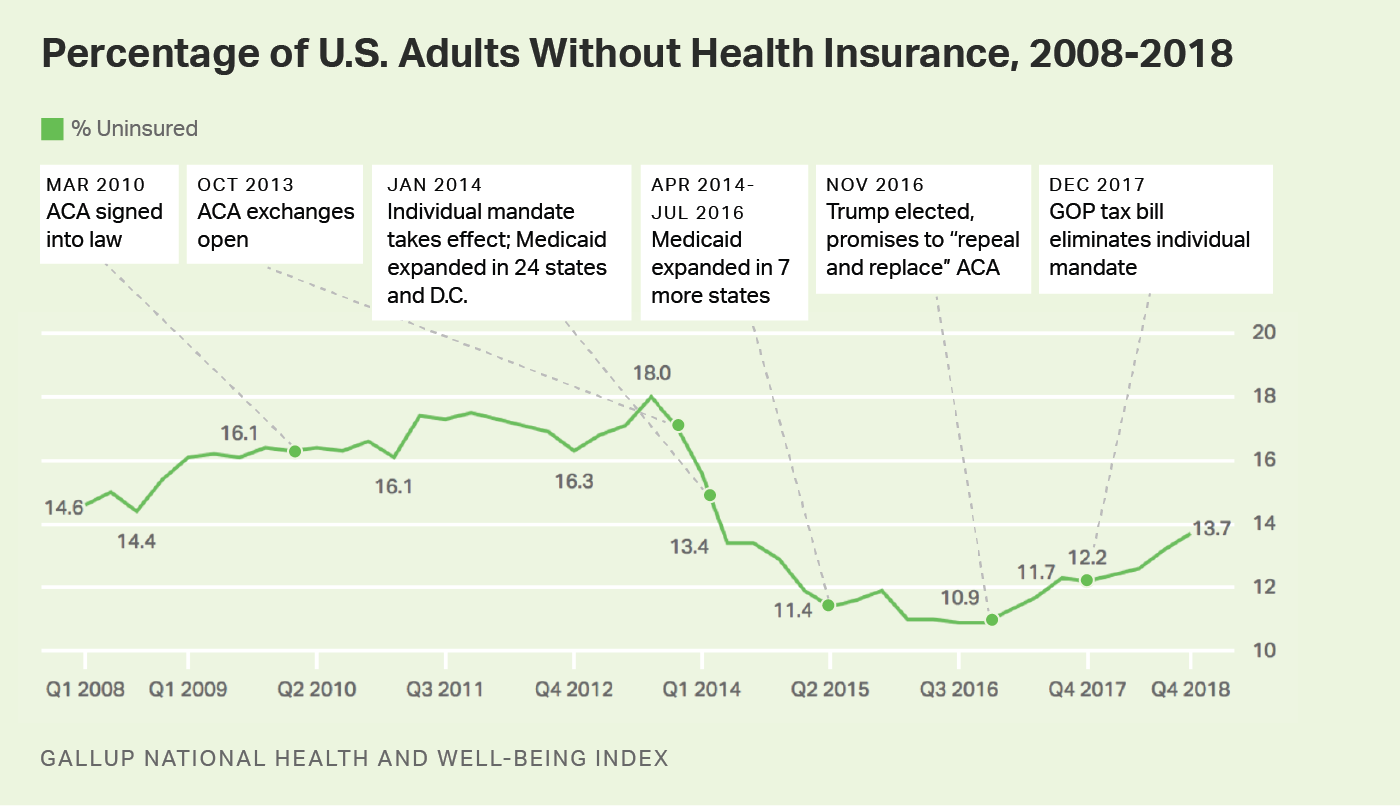

WASHINGTON, D.C. -- The U.S. adult uninsured rate stood at 13.7% in the fourth quarter of 2018, according to Americans' reports of their own health insurance coverage, its highest level since the first quarter of 2014. While still below the 18% high point recorded before implementation of the Affordable Care Act's individual health insurance mandate in 2014, today's level is the highest in more than four years, and well above the low point of 10.9% reached in 2016. The 2.8-percentage-point increase since that low represents a net increase of about seven million adults without health insurance.

Nationwide, the uninsured rate climbed from 10.9% in the third and fourth quarters of 2016 to 12.2% by the final quarter of 2017; it has risen steadily each quarter since that time. Since Gallup's measurement began in 2008, the national uninsured rate reached its highest point in the third quarter of 2013 at 18.0%, and thus, the current rate of 13.7% -- although it continues a rising trend -- remains well below the peak level.

These data, collected as part of the Gallup National Health and Well-Being Index, are based on Americans' answers to the question, "Do you have health insurance coverage?" Sample sizes of randomly selected adults in 2018 were around 28,000 per quarter.

The ACA marketplace exchanges opened on Oct. 1, 2013, and most new insurance plans purchased during the last quarter of that year began their coverage on Jan. 1, 2014. Medicaid expansion among 24 states (and the District of Columbia) also began at the beginning of 2014, with 12 more states expanding Medicaid since that time. Expanded Medicaid coverage as a part of the ACA broadens the number of low-income Americans who qualify for it to those earning up to 138% of the federal poverty level. The onset of these two major mechanisms of the ACA at the beginning of 2014 makes the uninsured rate in the third quarter of 2013 the natural benchmark for comparison to measure the effects of that policy.

The uninsured rate rose for most subgroups in the fourth quarter of 2018 compared with the same quarter in 2016, when the uninsured rate was lowest. Women, those living in households with annual incomes of less than $48,000 per year, and young adults under the age of 35 reported the greatest increases. Those younger than 35 reported an uninsured rate of over 21%, a 4.8-point increase from two years earlier. And the rate among women -- while still below that of men -- is among the fastest rising, increasing from 8.9% in late 2016 to 12.8% at the end of 2018.

At 7.1%, the East region, which has in recent years maintained the lowest uninsured rate in the nation, is the only one of the four regions nationally whose rate is effectively unchanged since the end of 2016. Respondents from the West, Midwest and South regions all reported uninsured rates for the fourth quarter of 2018 that represent increases of over 3.0 points. The South, which has always had the highest uninsured rate in the U.S. but has seen some of the greatest declines at the state level, has had a 3.8-point increase to 19.6%.

| Q4 2016 | Q4 2018 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | pct. pts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18-34 | 16.8 | 21.6 | +4.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35-64 | 11.0 | 13.7 | +2.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 65+ | 2.3 | 3.7 | +1.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18-64 | 13.1 | 16.3 | +3.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gender | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Men | 12.9 | 14.5 | +1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Women | 8.9 | 12.8 | +3.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual household income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Under $24,000 | 22.6 | 25.4 | +2.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $24,000-<$48,000 | 16.1 | 19.1 | +3.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $48,000-<$90,000 | 7.8 | 9.1 | +1.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $90,000-<$120,000 | 3.2 | 5.9 | +2.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $120,000 or more | 2.4 | 3.6 | +1.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Region | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| East | 7.5 | 7.1 | -0.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| West | 9.6 | 13.2 | +3.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Midwest | 7.7 | 10.9 | +3.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South | 15.8 | 19.6 | +3.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup National Health and Well-Being Index | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A number of factors have likely played a role in the steady increase in the uninsured rate over the past two years. One may be an increase in the rates of insurance premiums in many states for some of the more popular ACA insurance plans in 2018 (although most states saw premiums stabilize for 2019). For enrollees with incomes that do not qualify for government subsidies, the resulting hike in rates could have had the effect of driving them out of the marketplace. Insurers have also increasingly withdrawn from the ACA exchanges altogether, resulting in fewer choices and less competition in many states.

Other factors could be a result of policy decisions. The open enrollment periods since 2018 have been characterized by a significant reduction in public marketing and shortened enrollment periods of under seven weeks, about half of previous periods. Funding for ACA "navigators" who assist consumers in ACA enrollment has also been reduced in 2018 to $10 million, compared with $63 million in 2016. Overall, after open enrollment in the ACA federal insurance marketplace (i.e., healthcare.gov) peaked in 2016 at 9.6 million consumers, it declined by approximately 12.5%, to 8.4 million in 2019, based on recently released figures.

Other potential factors include political forces that may have increased uncertainty surrounding the ACA marketplace. Early in his presidency, for example, President Donald Trump announced, "I want people to know Obamacare is dead; it's a dead healthcare plan." Congressional Republicans made numerous high-profile attempts in 2017 to repeal and replace the plan. Although none fully succeeded legislatively, the elimination of the ACA's individual mandate penalty as part of the December 2017 Republican tax reform law may have reduced participation in the insurance marketplace in the most recent open enrollment period.

Trump's decision in October 2017 to end cost-sharing reduction could also potentially have affected the uninsured rate. The cost-sharing payments were made to insurers in the marketplace exchanges to offset some of their costs for offering lower-cost plans to lower-income Americans. The Trump administration had previously renewed the payments on a month-by-month basis but later concluded that such payments were unlawful. In April 2018, a federal court granted a request for a class-action lawsuit by health insurers to sue the federal government for failing to make the payments. Such lawsuits continue to be litigated.

Learn more about how the Gallup National Health and Well-Being Index works.

Results for 2018 are based on address-based sampling conducted over all 12 months with a random sample of 115,929 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia as a part of the Gallup National Health and Well-Being Index. Surveys could be completed by mail or by web, in either English or Spanish. About 20% of surveys each quarter were completed via web. Quarterly sample sizes ranged from a low of n=27,987 in the fourth quarter to a high of n=31,092 in the first quarter. Sampling done before 2018 used random-digit-dial telephone interviewing with a cellphone/landline ratio as high as 70%/30%.

The means of data collection (e.g., mail/web versus phone) can result in differing estimates for some metrics in randomized nationwide polling. Gallup has extensively studied these effects and has applied scientifically determined mode adjustments to its 2018 estimates to ensure comparability with the phone-based estimates that preceded them, thus effectively preserving past trending.

For quarterly results based on the total sample of national adults, the margin of sampling error for the uninsured rate is no more than ±0.5 percentage points at the 95% confidence level.